10 Golden Rules to Financial Management

Yahaan 10 Golden Rules to Financial Management ka vistaar se vivaran diya gaya hai, jo aapko apne finances effectively se manage karne mein help kar sakte hain:

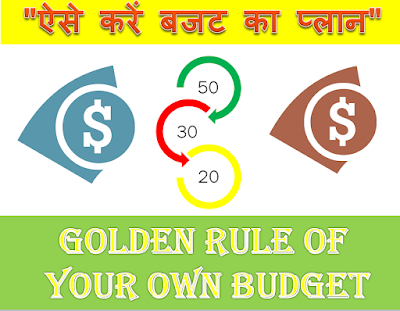

1. Budget banayein (make a budget )

Budget banane se

aapko apni income aur Expense ko track karne mein madad milti

hai. Yah jaanana ki aapka paisa kahaan ja raha hai, aapko aarthik nirnay lene

mein sahayak hota hai.

Kaise banayein :

- Apni maasik income ko suchibaddh karein.

- Sabhi kharchon (fixed aur variable) ko suchibaddh karein.

- Jaroori kharchon ke baad bache hue paise ko bachat aur nivesh ke liye

aavantarit karein.

- Apne Budget ko maasik aadhar par

niyamit roop se samiksha karein aur aavashyakta anusaar samayojit karein.

2. Create an emergency fund

Emergency kharchon

(jaise chikitsa aapaat sthitiyon ya naukri ka nuksan) se nipatne ke liye ek Emergency

Fund hona aavashyak hai. Yah aapko karz mein jaane se bachata hai aur maansik

tanav ko kam karta hai.

Kaise banayein :

- Apni maasik aavashyaktaon ka teen se chhe guna rashi bachaane ka

lakshya rakhein.

- Har maas apne bank khate mein ek nishchit rashi jama karein, jab tak

aap apne lakshya tak nahi pahunch jaate.

- Is paise ko ek uch-byaaj bachat khate mein rakhein taaki yah aasani se

uplabdh ho.

3. Uch byaaj wale karz ka bhugtaan karein (Pay off high interest debt)

Uch byaaj dar wale

karz (jaise credit card ka karz) aapke vit ke swasthya ko nuksan pahunchate

hain. Inka samay par bhugtaan karna aapke vitiy bojh ko kam karne mein madad

karta hai.

Kaise karein :

- Sabse pehle un karzon par dhyaan dein jinki byaaj dar sabse adhik

hai.

- Do tareeke apnaayein:

- Avalanche vidhi : Uchit byaj wale karz ko pehle

chukayein.

- Snowball vidhi : Sabse chhote karz ko pehle chukayein, jisse

aapko maansik santosh mile aur aap aage badh sakein.

4. Jaldi bachat aur nivesh karein ( Save and invest early)

Jaldi bachat aur

nivesh karne se chakravardhi byaaj ka labh uthaaya ja sakta hai. Yah aapke dhan

ko lambe samay mein badhane mein sahayak hota hai.

Kaise karein :

- Apni aay ka ek hissa niyamit roop se bachat aur nivesh khaton mein

daalein.

- Retirement funds (jaise 401(k), IRA) mein nivesh karne par vichar

karein.

- Mutual funds ya stocks mein bhi nivesh karein, jisse aapko lambi avadhi

mein labh mil sake.

5. Apne saadhanon ke bheetar jiyen (Live within your means)

Apne

kharchon ko apni aay se kam rakhna aapko anavashyak karz se bachne mein madad

karta hai. Yah aapko adhik bachat karne aur nivesh karne ka avsar pradaan karta

hai.

Kaise karein :

- Kharchon ko prathmikta dein aur keval aavashyak cheezon par kharch

karein.

- Atirikt kharchon se bachne ke liye ek kharidari suchi banayein aur use

hi prathmikta dein.

6. Khud ko shikshit karein (Educate yourself)

Vyaktigat

vit ke baare mein gyaan prapt karna aapko adhik soochit nirnay lene mein madad

karta hai. Behtar gyaan se aap apne vit ka sahi prabandhan kar sakte hain.

Kaise karein :

- Vyaktigat vit par kitabein padhein, vittiya podcast sunen aur online pathyakramon

mein bhaag lein.

- Sthaniya samudaayik karyakramon ya karyashaalon mein bhaag lein, jahan

vittiya visheshagya aapko salah de sakte hain.

7. Vittiya lakshya nirdharit karein (Set financial goals)

Clear and measurable

financial goals ka hona aapke vittiya prayason ko ek disha aur uddeshya deta

hai. Isse aap apne kharchon aur bachat ko sahi tareeke se prabandhit kar sakte

hain.

Kaise karein :

- Apne lakshya ko SMART (Specific, Measurable, Achievable, Relevant,

Time-bound) maanak ke anusar sthapit karein.

- Chhote lakshyon ko prapt karein aur unhe bade lakshyon ki disha mein ek

kadam ke roop mein dekhein.

8. Niyamit roop se samiksha aur samayojan karein (Review and adjust regularly)

Aapki vittiya

sthiti samay ke saath badalti hai, aur niyamit samiksha se aapko yah samajhne

mein madad milti hai ki kya aapki yojana prabhavi hai ya nahi.

Kaise karein :

- Har maas ya timahi mein apne Budget aur lakshyon ki samiksha karein.

- Apni sthiti ke anusaar aavashyakta anusaar samayojan karein.

9. Jeevanshailee mein vriddhi ke prati sachet rahein (Be aware of lifestyle changes )

Jab

aapki aay badhti hai, to jeevan shailee mein badlav ke liye pralon bhadak

rahega. Ise niyantrit karna aapki vittiya sthirata ke liye mahatvapurn hai.

Kaise karein :

- Apni vartaman jeevan shailee ko banaye rakhne ka prayas karein, bhale

hi aapki aay badhe.

- Bhavya kharchon se bachne aur pehle se nirdharit bachat aur nivesh

yojanaon ko prathmikta dene par dhyaan dein.

10. Peshawar salaah lein (Seek professional advice)

Ek vittiya

salaahakar aapki vyaktigat sthiti ke aadhar par salaah dene mein saksham hote

hain. Ve aapke lakshyon aur jokhim sahishnuta ke anusar ek anukulit yojana

banane mein madad kar sakte hain.

Kaise karein :

- Ek pramanit vittiya salaahakar se samvaad karein jo aapke vittiya

lakshyon ko samajhta ho.

- Salaahakar se milne se pehle apni vittiya jaankari tayyar rakhein taaki

aap sahi disha mein aage badh sakein.

Conclusion

In 10 Golden Rules to Financial Management

ka plan karne se aap apni vittiya sthiti

ko majboot kar sakte hain aur apne deerghkalik lakshyon ko prapt kar sakte

hain. Har ek niyam ka sahi tareeke se palan karne se aapke vittiya jeevan mein

sudhaar hoga aur aap ek sthir aur surakshit bhavishya ki or badh sakenge.

Anushasan aur yojana ke saath, aap apni aarthik chunautiyon ko paar kar sakte

hain aur ek safal vittiya jeevan ki disha mein badh sakte hain.

Technical Analysis Related Topics

Technical Analysis in Hindi: A Comprehensive Guide for Beginners

Stock Market Related Topics

How Psychological Factors Impact Stock Market Decision?

Why Do People Sell Stocks When Market Goes Down?

Share Market me Share Kaise Kharide?

Share Market Me Paise Kaise Lagaye in Hindi

Difference between preferred stock and common stock in Hindi

What happens if I invest 1000 in SIP for 10 years?

Share Market Kaise Kaam Karta Hai?

Swing Trading Kya Hai aur ye kaise kaam karta hai?

Equity Delivery Aur Intraday Trading Mein Kya Farq Hai?

Equity Trading Kya Hai Aur Kaise Karein? Dhan Profit

Trading Kya Hai Aur Kaise Kare: Detail In Short Hindi

Investment Strategy Related Topics

Stock Market mein risk kam karne ke tareeke

Which of the following statements is not true about preferred stock? Hindi me

What are the most useful money investment and saving tricks?

What are the top stock market indices to follow in India for investment?

What is strategy plan when your portfolio hits 10 lakh? Hindi me advice

Stockbroker Related Topics

Brokerage Account and Demat Account Difference In Hindi

Angel Broking 1 Live your dreams with the No.1

Comments

Post a Comment